Work Delivered

Art Direction & Branding

Product Strategy

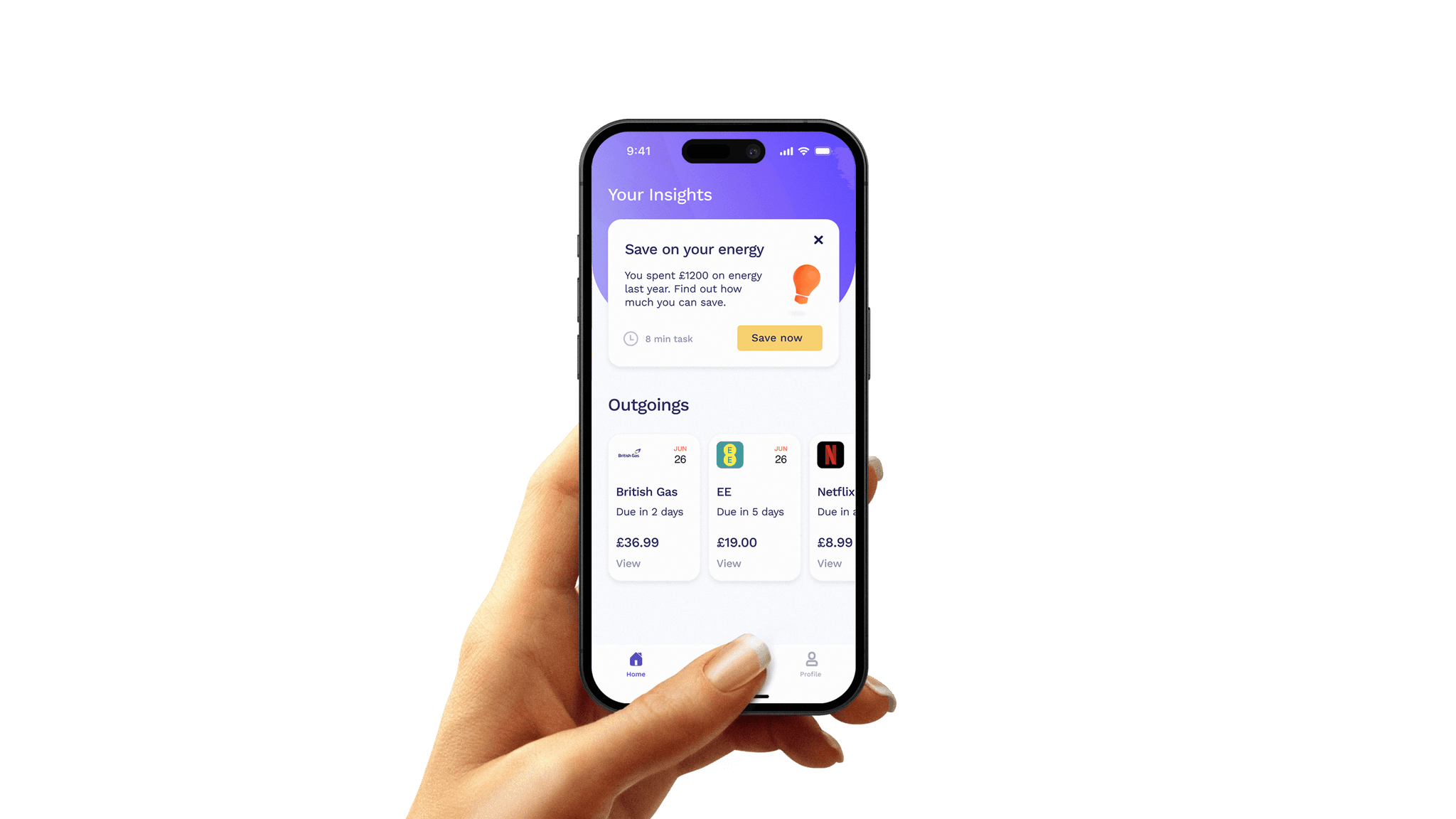

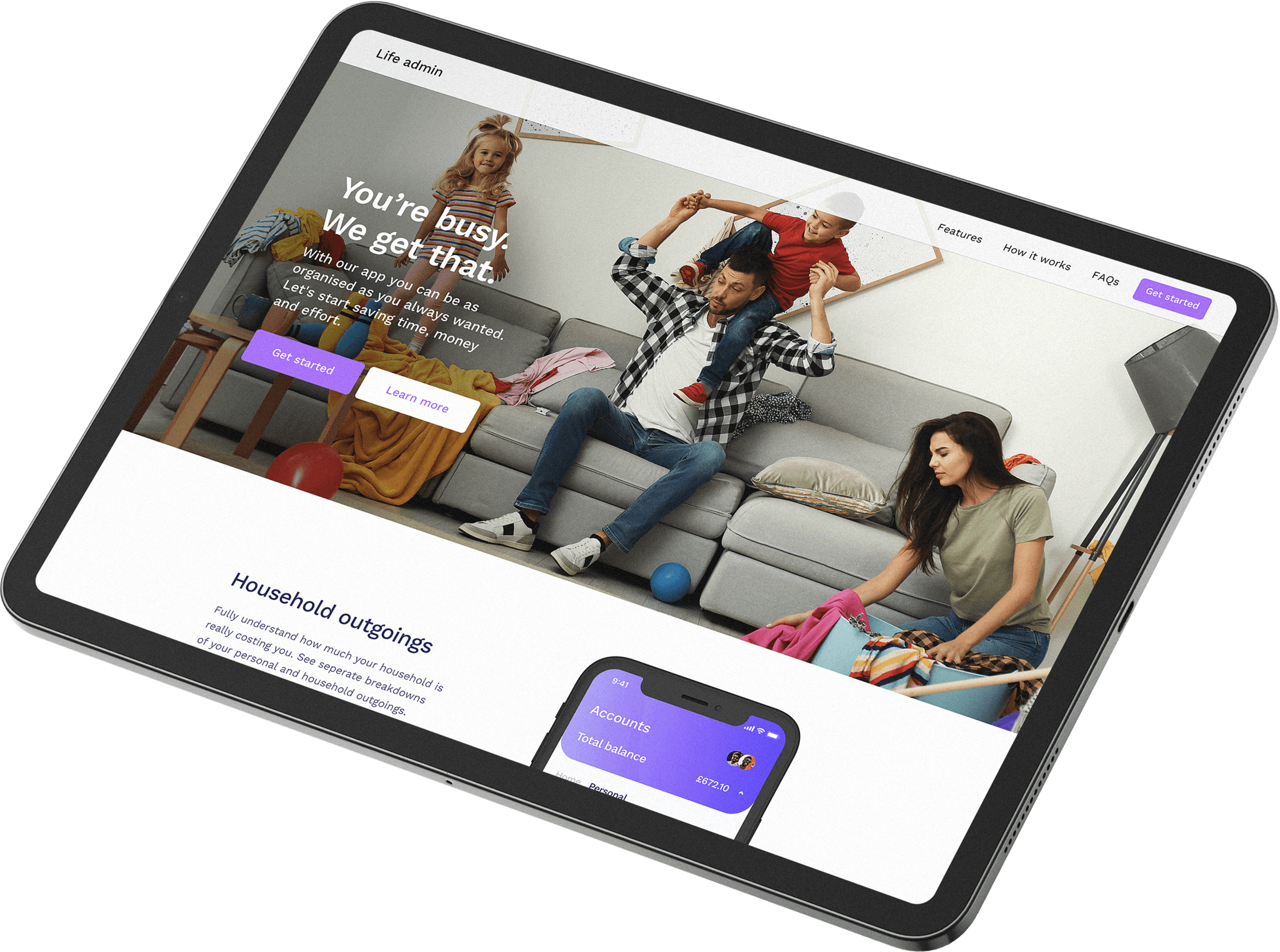

UI/UX Design

Results

0-1 App Product

Introduced Agile Design

Navigated Regulations

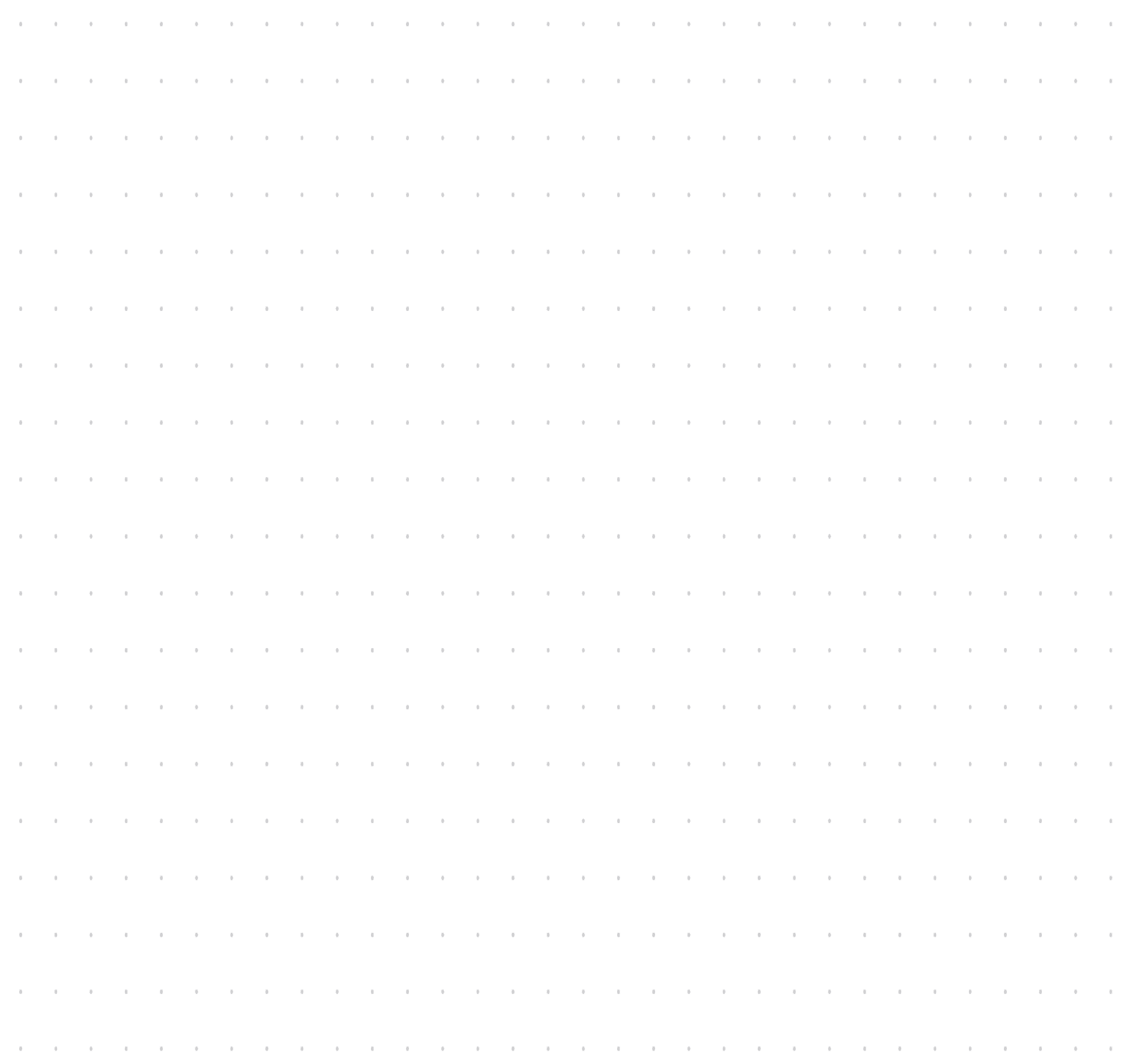

Subscriptions and rising costs used to be a hassle, now it’s a thing of the past.

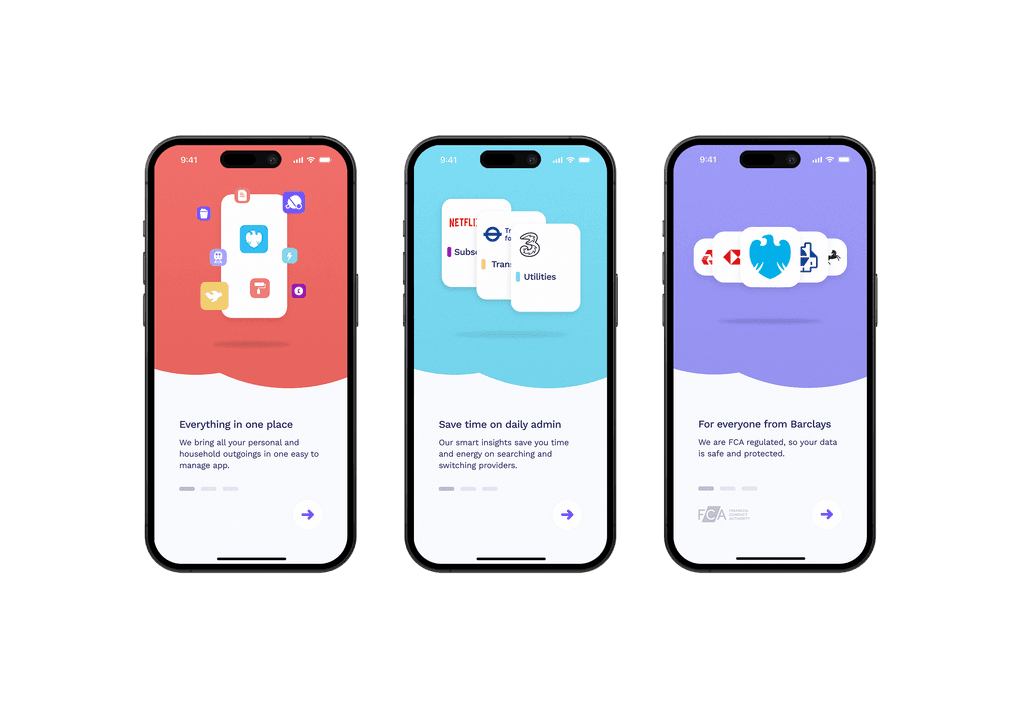

Barclays launched Barclays Ventures (BV) to keep the bank relevent and innovate faster in response to evolving competition from start-up banks, disruptive apps, and new regulations like Open Banking.

As a founding designer at BV, I led the 0-1 product design, research and strategy for the 'Life admin' app. I also established internal design processes for venture's projects and oversaw multiple initiatives.

Life can feel overwhelming, especially for young adults and new families. Many struggle with rising costs and the constant demands of managing bills, utilities, and everyday expenses.

Why Life Admin?

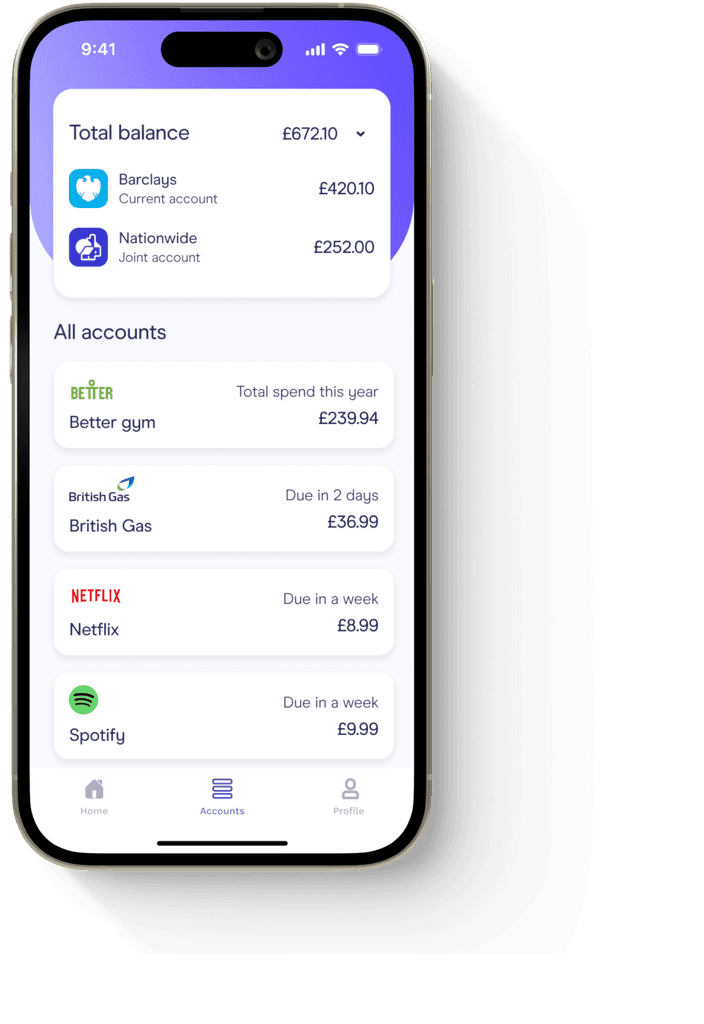

Life Admin was created to ease financial management for young professionals and new families who feel overwhelmed by increasing costs and administrative responsibilities. The app uses open banking, Barclays' datasets, and AI to assist users.

Automate financial tasks, saving time and money.

Compare providers and identify better deals

Consolidate accounts and subscriptions.

Research & Consumer Insights

After conducting extensive user research through surveys and short one-on-one sessions, I identified three key themes that shaped the app's design and communication strategy.

Strategic objectives

Personalisation

Users wanted tailored recommendations based on their financial habits and goals.

Always the best deal

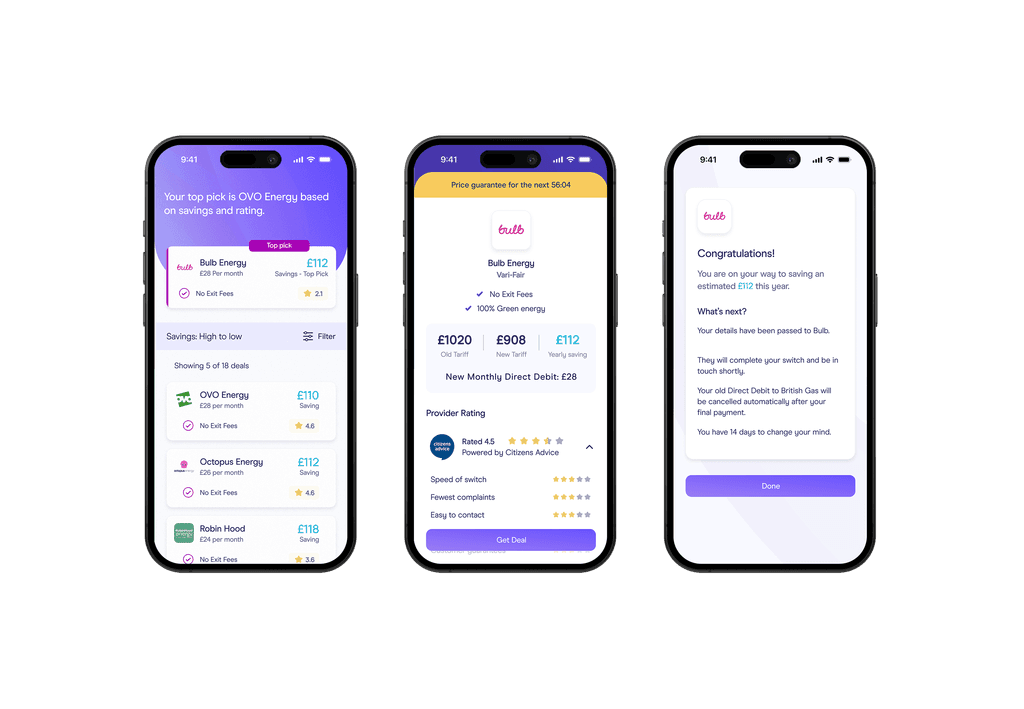

Remove the complexity of comparing and switching to ensure users get the best deal.

Full picture approach

Provide a holistic look at all outgoings, with a simple view of multiple subscriptions and accounts.

Target Audience

Barclays commissioned a quantitative and qualitative study involving a nationally representative sample of 804 adults conducted by Illuminas. The study explored and captured attitudes towards administrative tasks, current life admin behaviours, and responses to the proposed life admin initiative.

The outcome helped us focus our target audience:

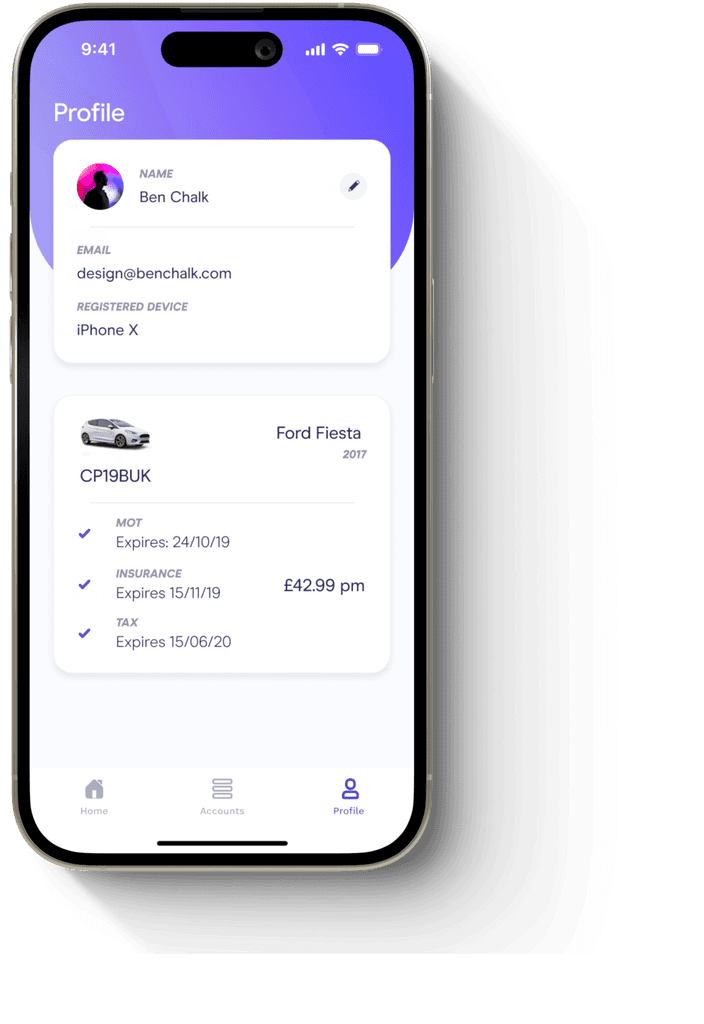

Demographic: Young professionals (24-34) and new families who wanted better financial control.

Behavioural: 'Enthusiastic Amateurs' and 'Resigned But Relaxed' personas resonated with the proposition most.

Behavioural Insights

Insights uncovered informed the UX. Task completion, progress tracking and single-user empowerment formed the guiding principles for our interface and usability.

Satisfaction Through Organisation

Users felt rewarded when bringing financial order out of chaos and completing tasks.

Single-Owner Approach

Households managed finances more effectively when one person took full ownership.

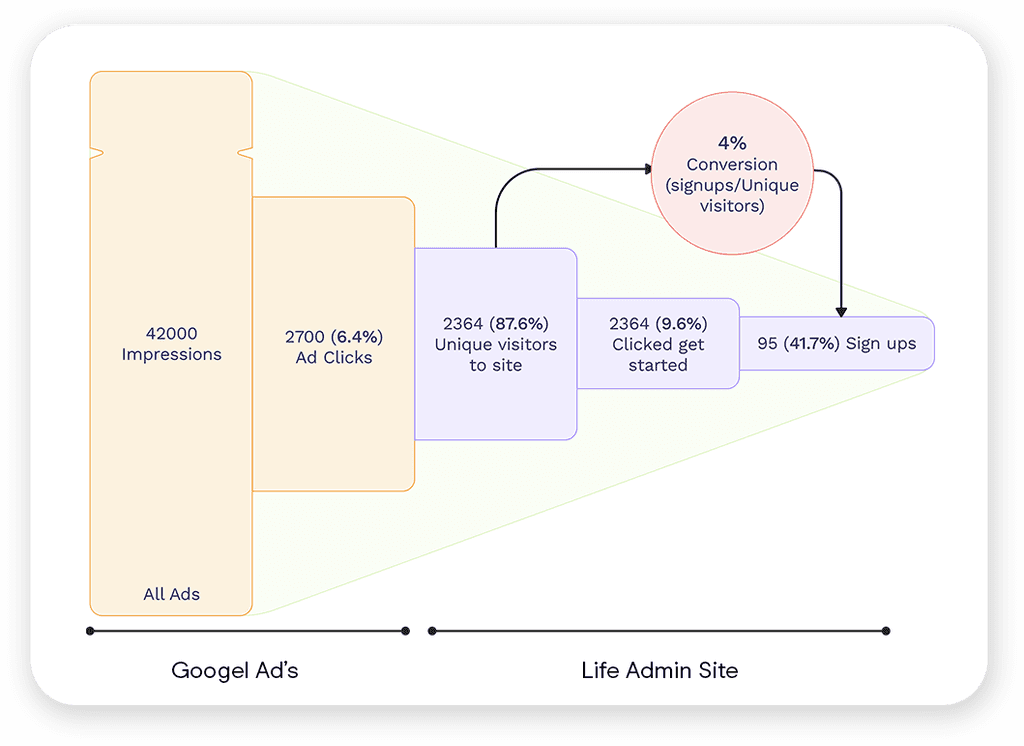

Smoke Tests & Prototypes

To navigate Barclays Ventures' funding gates and regulatory hurdles, we used iterative smoke tests and prototypes to continually gauge consumer interest and feedback.

A/B and Usability testing ensured clarity and ease of use before development.

Ran bi-weekly sessions to ensure constant customer feedback loops, helping to refine the experience.

Ran two week-long smoke tests to gauge consumer interest (Ad clicks, site conversion, and sign-up rates)

Smart, simple, and rewarding

To structure and design the Life Amin app, I leaned into two behaviour principles to ensure the design would make life smart, simple, and rewarding for customers.

Behavioural Insights

Framing

Consumers make very different decisions based on how facts are presented,

Endowed Progress Effect

Customers reach goals faster when they have help getting started.

Framing

Framing is among the most powerful behavioral tools in design. Anything can be reframed based on the desired outcome.

Reframing how the information is presented visually, I increased engagement on the insights.

Further iterating the insight copy and CTA, I persuaded more customers to take action.

Endowed Progress Effect

The Endowed Progress Effect can be a great way to set customers up for success by helping them get started.

I designed the app to show insights only after we have completed the initial work, making tasks less daunting.

I designed the flows to ensure we pre-fill basic info to help customers speed through steps and focus on the bigger picture.

Designing for Trust

Life Admin needed to attract and convert existing and non-Barclays users; building trust was crucial. We approached this both in the Vidual design and by creating partnerships.

We partner with Citizens Advice, who bring an independent verified rating for suppliers and peer reviews.

Transparent recommendations showing why a switch or offer was suggested, along with the data point it was compared with.

Branding & Communication, The app is designed to maintain a neutral look and feel and communicated as 'Powerd by Barclays'